Project details

Client: B2B cybersecurity SaaS company (mid-market + enterprise)

Location: US + EU

Industry: Cybersecurity SaaS / cloud security / SecOps tooling

Goal: Build a predictable inbound engine from SEO + AI search visibility, with trusted reporting and measurable pipeline impact.

The client had strong product-market fit and an experienced sales team, but inbound demand was inconsistent, and internal performance data wasn’t trusted. Their search footprint was fragmented, competitors were noisy, and security buyers were skeptical. aboveA rebuilt the growth system end-to-end, fixing tracking integrity, aligning page architecture to commercial security intent, reducing demo and security-review friction, and connecting reporting to CRM outcomes so lead quality and pipeline influence were clear.

Services Provided:

-

Cybersecurity SaaS demand generation strategy and ICP refinement

-

Measurement cleanup (GA4 + Google Tag Manager) and attribution governance

-

Commercial SEO architecture (SOC 2 readiness, CSPM, fraud prevention, SIEM/SOAR alternatives)

-

Integration pages and competitor/alternative pages for evaluation-stage intent

-

Conversion rate optimization (CRO) for demo and security-review paths

-

Lead qualification rules and routing aligned to enterprise buying signals

-

CRM visibility and reporting dashboards for pipeline tracking and governance

Top Challenges:

Inconsistent inbound pipeline and rising paid search costs

Tracking integrity issues and unreliable attribution across tools

Intent mismatch: high-intent searches landing on generic pages

Weak differentiation vs competitors during evaluation

Friction in demo booking and security review readiness paths

Lead qualification gaps that diluted sales focus and pipeline quality

Services Employed

SaaS SEO Services

SEO designed to capture problem- and solution-aware demand through education, comparisons, and product-led pages that drive signups.

Lead Generation Systems

We build automated lead generative systems that target and engage potential customers, streamline prospecting, and optimize conversion rates

SaaS

Gain more trial signups, reduce churn, and convert users with comprehensive full-funnel optimization strategies and long-term organic strategies.

Fintech

Attract users and improve conversions with fintech-specific marketing strategies for trust, visibility, and user acquisition.

Partner-Led Fintech Growth Without Cold Sales Pressure

- Last time updated: 31th of January, 2026

Partner-led fintech demand generation is what turned this story around. This B2B fintech/regtech company sold payments risk controls and compliance infrastructure to finance, risk, and ops leaders, but demand was weak, and trust was fragile. The pipeline felt cold. Prospects hesitated because the risk felt unclear, the category felt noisy, and the vendor looked new. Instead of pushing harder, aboveA built a partner + integration growth path that made the offer believable and made evaluation simple.

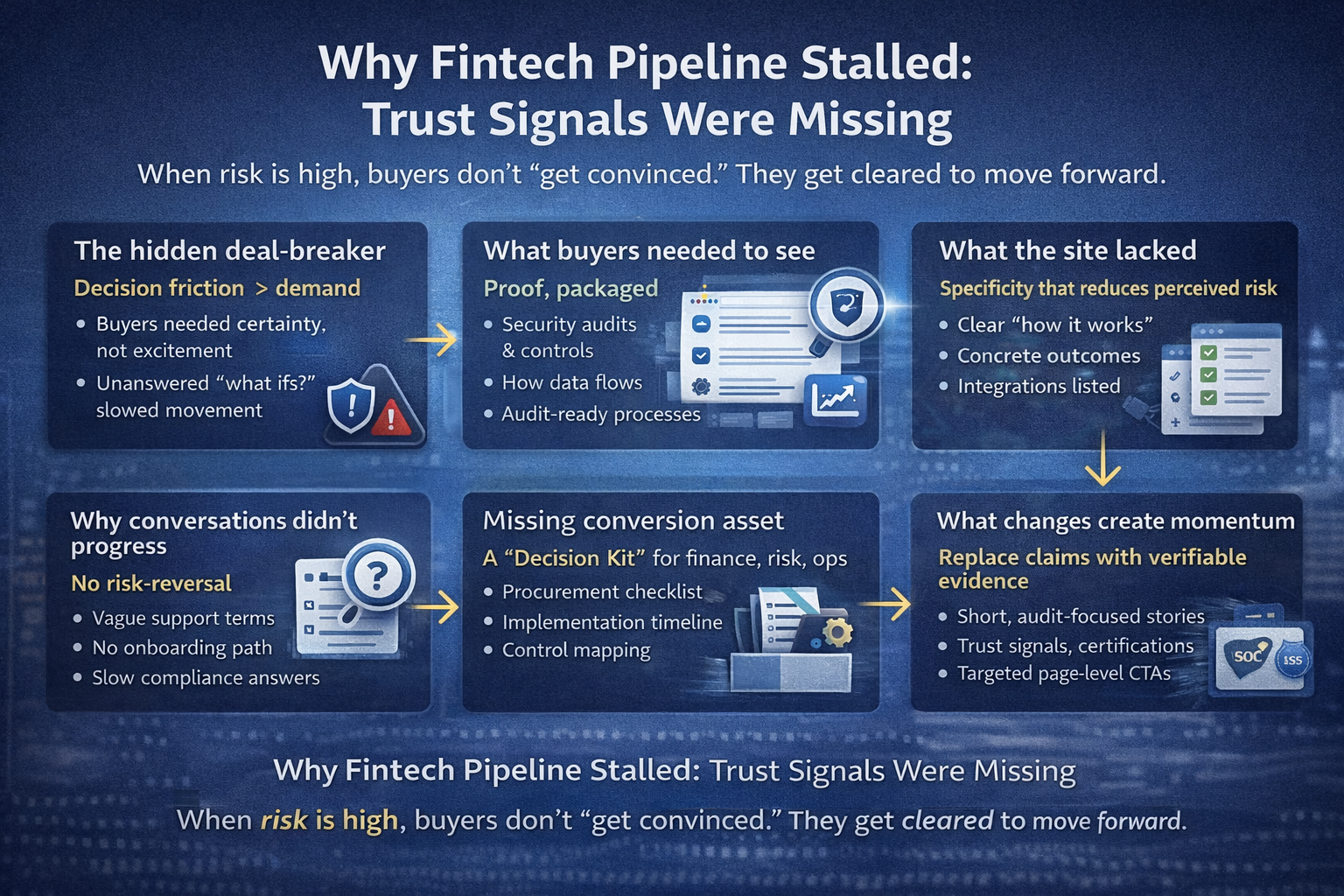

Fintech Demand Generation Had Low Confidence

The main issue was that the client’s leads were scarce, and the few inbound conversations were cautious. Sales calls started with skepticism, not momentum. Buyers delayed decisions because switching risk felt high, compliance questions were slow to answer, and the website didn’t give enough proof to justify a shortlist.

Even when prospects searched commercial queries like AML/KYC software, fraud prevention platform, or payments compliance solution, they landed on pages that sounded generic. The result was predictable: low confidence, longer sales cycles, and too many “circle back next quarter” outcomes.

Regtech Integration Partner Built Credibility

The move that changed everything was a strategic ecosystem alignment. We helped the client secure a reseller + co-marketing partnership with a trusted platform already embedded in their buyers’ workflows (a widely used payments operations and reconciliation provider). That partner mattered because it reduced perceived risk instantly. It signaled, “this is safe to evaluate,” before a demo even happened.

We framed the partnership around a simple promise: less compliance friction, faster onboarding, and clearer operational outcomes. The partner also solved a distribution problem the client couldn’t brute-force with ads. Instead of chasing every fintech, we built a channel that delivered pre-qualified conversations from an audience that already had intent.

| Commercial search query | What we built | Why it converted |

|---|---|---|

| AML/KYC platform for fintech | Partner-ready solution page | Trust transfer + clear scope |

| transaction monitoring software | Integration workflow page | Reduced “how does it work?” |

| payments fraud prevention tool | Use-case page + proof blocks | Lower fear, faster evaluation |

1. Fintech positioning shift for partner-ready messaging and conversion

Partner-ready fintech positioning changed everything. Once the integration partner was secured, we rewrote the offer so a risk team could understand it in one breath. We removed vague “all-in-one” language and mapped every page to evaluation searches, not vanity traffic.

That meant the site could win and convert queries like AML compliance automation, KYC verification workflow, fraud prevention platform, transaction monitoring software, and regtech integration.

Key execution upgrades included:

A single-sentence value prop tied to reduced chargebacks and faster onboarding

Partner-branded solution pages for co-marketing and reseller handoffs

Integration pages showing data flow, setup steps, and compliance boundaries

Use-case pages for payments fraud detection and lending risk monitoring

Proof blocks: SOC 2 language, security review checklist, and audit-ready FAQs

Finally, we embedded the partner signal with restraint logos only where they added meaning, and joint outcomes where they added trust. The result was clearer differentiation, warmer demos, and fewer stalled deals. It also improved conversion rate optimization and partner-led demand generation for fintech teams.

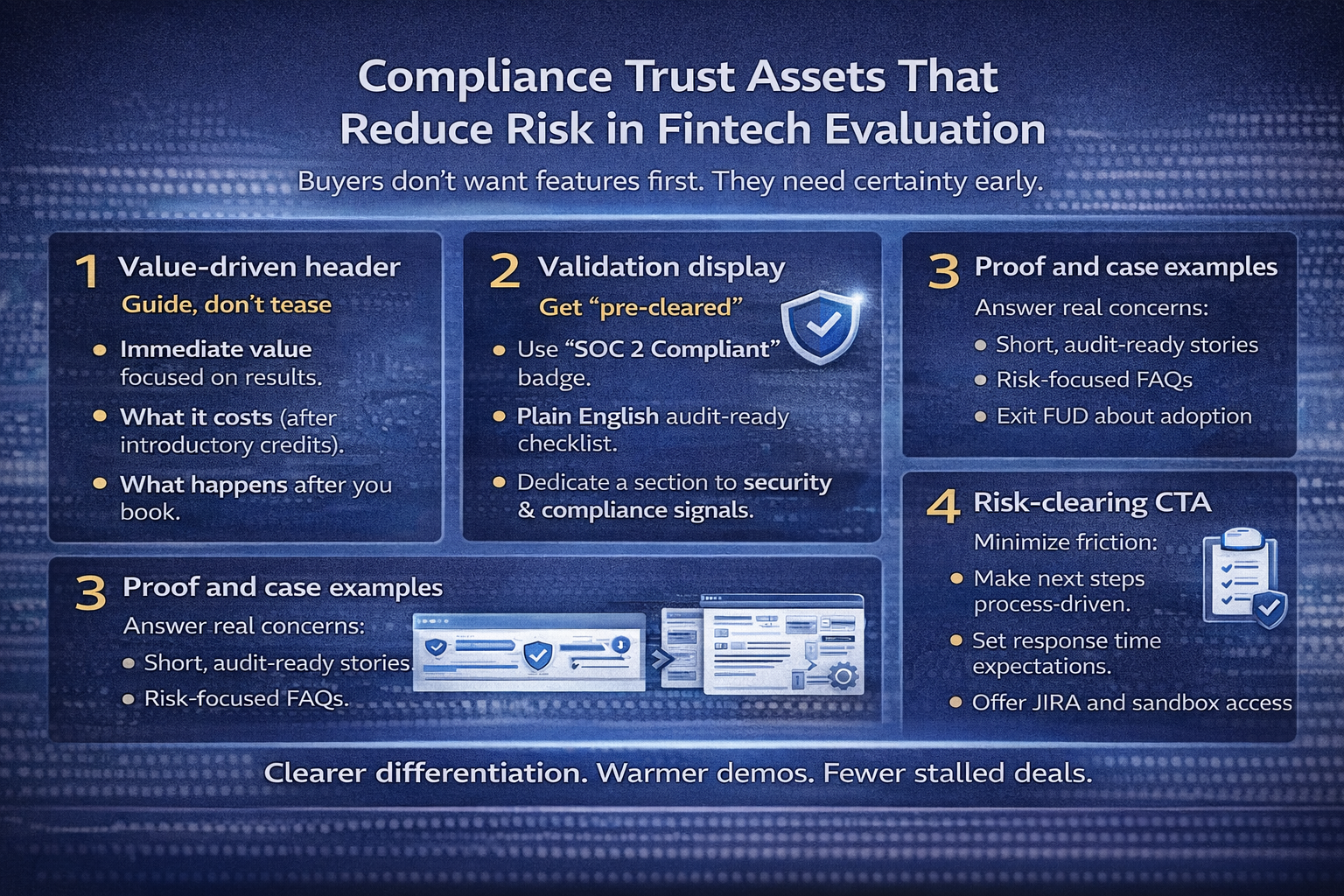

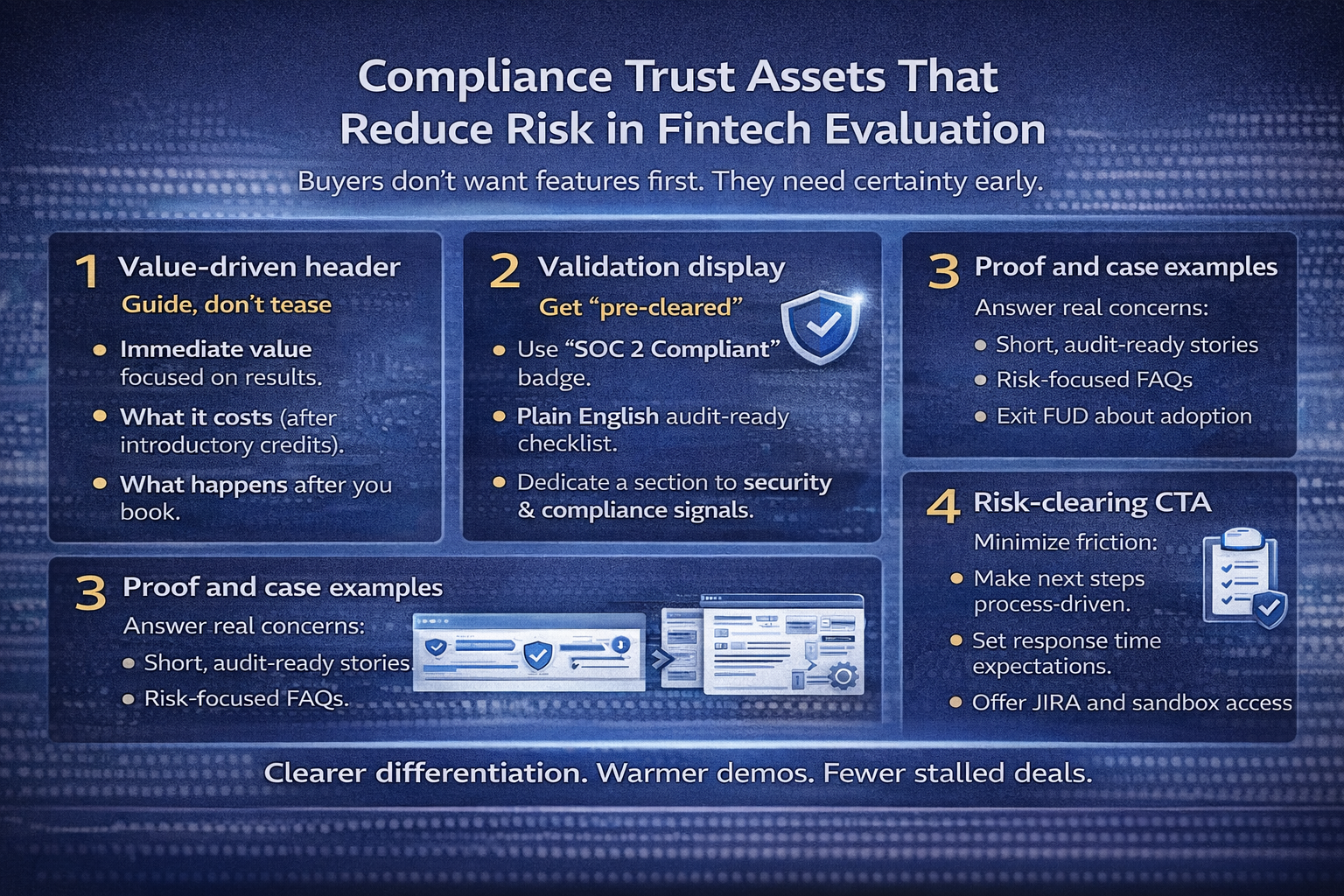

2. Compliance trust assets that reduce risk in fintech evaluation

We dived in with the knowledge that fintech buyers don’t buy features first. They buy certainty. In that sense, we built trust assets that answered the hard questions early and removed the “risk fog” that stalls deals. We made compliance proof visible, security language clearer, and evaluation steps predictable.

We introduced a tight set of proof blocks that supported high-intent searches like SOC 2 compliant fintech vendor, AML audit readiness, and payment risk controls. We also added case evidence, clearer onboarding steps, and a “what happens after you book” explanation that reduced anxiety.

The goal was not to overwhelm the page. It was to make the buyer feel safe enough to move. When prospects could validate credibility quickly, the conversation shifted from “can we trust you?” to “how fast can we implement this?”

3. Fintech buyer objection handling for faster decisions and warmer calls

Uncertainty was handled like a product problem, not a sales problem. That’s why we mapped the common objections: implementation risk, compliance exposure, false positives, operational burden, stakeholder approvals, and designed pages to address them. This was done in the order that buyers actually worry about them. Short sections, clear definitions, and specific outcomes did more than long persuasion copy.

Our team also simplified the evaluation. The partner channel gave prospects a familiar reference point. The integration pages showed exactly how data flows. The onboarding path explained timeframes and responsibilities. That reduced internal friction for the buyer. It also made sales calls warmer, because prospects arrived with context, not confusion.

Partner-led fintech demand generation: results

In five months, demand stopped feeling cold. The integration partnership boosted credibility fast, and partner-ready pages turned searches like AML/KYC software and fraud prevention platform into warmer conversations. Evaluation became simpler, sales cycles shortened, and lead quality improved through a repeatable partner-led channel.

Warmer Leads From Partner-Led Fintech Demand Generation

Partner-led fintech demand generation turned outreach from “introductions” into “endorsed referrals.” The partner channel delivered prospects who already trusted the category fit, which reduced friction on first calls.

When buyers searched for AML/KYC software, fraud prevention platform, or payments compliance solution, the partner positioning made the message feel safer and more credible.

Co-marketing assets and shared audiences did the heavy lifting, so conversations opened with needs and timelines, not skepticism. The result was a steady flow of warmer leads that were easier to qualify, easier to route, and far more likely to enter a real evaluation cycle instead of disappearing after a first call.

Higher Conversion on Integration Pages for AML/KYC and Fraud Prevention

Commercial-intent pages converted better because they matched how risk teams evaluate. We rebuilt integration and workflow pages to answer the real blockers early: how data flows, what gets monitored, what is logged, and where compliance boundaries sit. Searches like transaction monitoring software, KYC verification workflow, and regtech integration landed on pages designed to reduce uncertainty fast and move prospects forward.

| Commercial search query | Page type we built | What we clarified to convert |

|---|---|---|

| transaction monitoring software | Workflow + solution page | monitoring scope, alerts, audit trail |

| KYC verification workflow | Integration page | data sources, checks, handoff steps |

| regtech integration | Integration hub page | architecture, boundaries, setup timeline |

| fraud prevention platform | Use-case page | outcomes, controls, proof blocks |

Next, we added security language, onboarding steps, and compliance proof where it mattered. As a result, demo requests became more qualified, risk questions appeared earlier (not late-stage), and the funnel filtered low-intent visitors without losing high-intent demand.

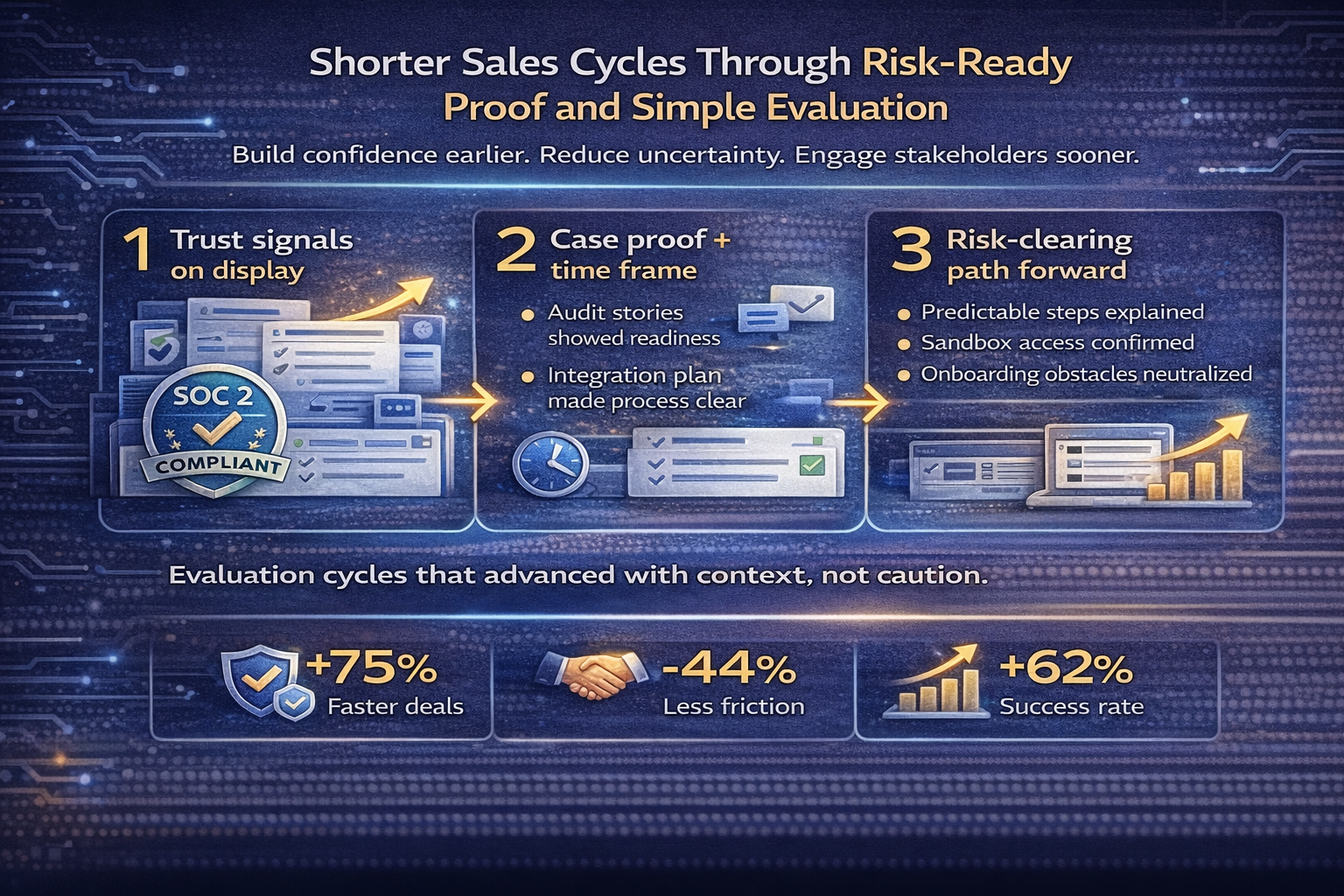

Shorter Sales Cycles Through Risk-Ready Proof and Simple Evaluation

Fintech deals stall when perceived risk stays vague. We made risk review simpler by packaging compliance proof and evaluation steps into a predictable path.

Prospects searching SOC 2 compliant fintech vendor, AML compliance automation, or payments fraud detection could quickly confirm credibility before involving more stakeholders. Objections were handled earlier, not left for late-stage calls. The onboarding story became clear: what happens after the demo, what documentation exists, and what implementation looks like.

This reduced hesitation, shortened evaluation cycles, and increased the number of opportunities that progressed with confidence instead of waiting for “next quarter.”

Why it worked:? Partner Legitimacy and Evaluation Paths

In conclusion, this project worked because we didn’t try to “market harder.” We made the offer safer to choose. The partner made the product believable, and the integration made it understandable.

The trust assets made it defensible inside a risk-first buying committee. Commercial pages captured searches with intent. Objection handling reduced fear. As a result, lead quality rose, and the pipeline became repeatable.

Build a Fintech Pipeline for Revenue-First Results

Fintech Partner-Led Growth FAQ

How does partner-led growth help fintech demand generation in 2026?

Partner-led growth reduces buyer fear fast. A trusted reseller, ecosystem partner, or co-marketing ally transfers credibility, warms conversations, and turns searches like AML/KYC software and fraud prevention platform into higher-intent demos.

What commercial search queries should a regtech website target first?

Start with evaluation keywords: AML compliance automation, transaction monitoring software, KYC verification workflow, fraud prevention for payments, payments compliance solution, and SOC 2 compliant fintech vendor.

Why do integration pages convert better than generic product pages?

Integration pages remove uncertainty. They show real workflows, data flow, setup steps, and outcomes. That makes evaluation easier for risk teams searching AML/KYC platform integrations or transaction monitoring integration.

What trust assets increase conversion for fintech and regtech buyers?

Compliance proof and clarity win. Use SOC 2 or equivalent security language, audit readiness explanations, data handling statements, onboarding timelines, and short case evidence that supports risk-first evaluation.

How do you avoid keyword stuffing while using fintech commercial keywords?

We map one query family to one page, use natural variations, and keep sections genuinely helpful. This aligns with people-first SEO and avoids spam signals while still capturing high-intent searches.